45+ assumption of mortgage after death of parent

We Are Committed To Helping You Achieve Your Financial Goals Through Education. Web In terms of handling the mortgage after the death of a parent it depends on the estates standing.

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

Web A mortgage holder cant legally exercise a due-on-sale clause in a divorce or when a parent passes away and leaves the home to offspring in a will.

. If you were married and your spouse was included as a borrower on the original mortgage you may need to complete an assumption following. If upon your fathers death you wanted to sell the home you could do that and youd pay off the mortgage at the time of the sale. Web An assumable mortgage is a home loan that can be transferred from the original borrower to the next homeowner.

If there is a Trust. Theyre not personally liable for the debt and. Web Up to 25 cash back The right to potentially assume take over the mortgage.

Web On the issue of the mortgage. Web To assume your fathers mortgage you must secure ownership of the property. Web Up to 25 cash back It even encourages lenders to allow the assumption of a mortgage either at the contract rate of interest or at a rate between the contract rate and the market rate.

Its up to the executor to handle the deceaseds estate which. The interest rate and payment period stay the. All successors in California have a right to apply for an assumption of the loan as long as the.

Web When the last surviving parent dies and a child or children inherit the family home they also inherit any mortgage. Web If youve assumed the mortgage of a loved one who has passed you have options for handling their home loan including refinancing. Ad Instant Download and Complete your Mortgage Assumption Agreement Forms Start Now.

First your fathers estate may have to go through probate depending on the. Ad Read Our Homeownership And Mortgage E-Books To Help Improve Your Home Ownership Literacy. Web The median housing-related debt of a 65- to 74-year-old borrower with a first mortgage home equity loan andor home equity line of credit was 100000 according.

Your mortgage lender still needs to be repaid and could foreclose on your home if that. The Leading Online Publisher of National and State-specific Real Estate Legal Documents. Web In a Divorce situation.

Choosing to refinance may. Provide a copy of the Birth Certificate and Death Certificate of your parent who was the borrowers child. If the assuming borrower does not qualify to assume the existing loan heshe may choose to apply for a new loan by simply contacting a mortgage loan officer at.

Web When you pass away your mortgage doesnt suddenly disappear. Web of filing date after the date of death.

Kaiserslautern American Aug 16 2013 By Advantipro Gmbh Issuu

Herald Union July 4 2013 By Advantipro Gmbh Issuu

Zpdhp5b5cqsqgm

Pdf European Times Public Opinion On Europe Working Hours Compared And Explained Paul Dekker Academia Edu

The 120 Best Blues Albums Classic Records You Need To Hear

Reforms Incentives And Flexibilization Five Essays On Retirement

The Out Of School Children S Programme In Nepal An Analysis

Ex107jeffersonatperim6e2

Abstracts From The 11th International Congress Of Behavioral Medicine Springerlink

Culture And Human Fertility A Study Of The Relation Of Cultural Conditions To Fertility In Non Industrial And Transitional Societies

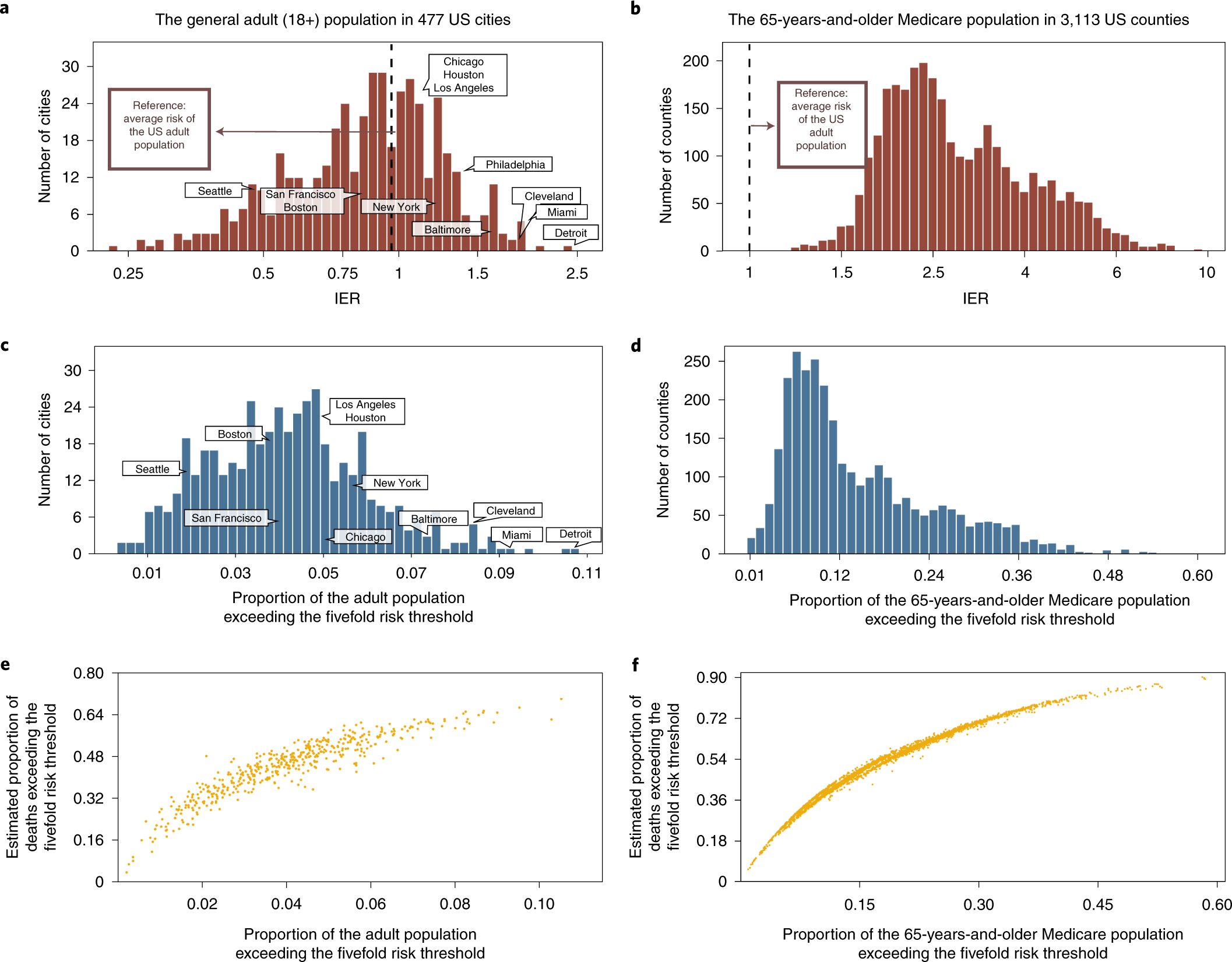

Individual And Community Level Risk For Covid 19 Mortality In The United States Nature Medicine

Ex107jeffersonatperim6e2

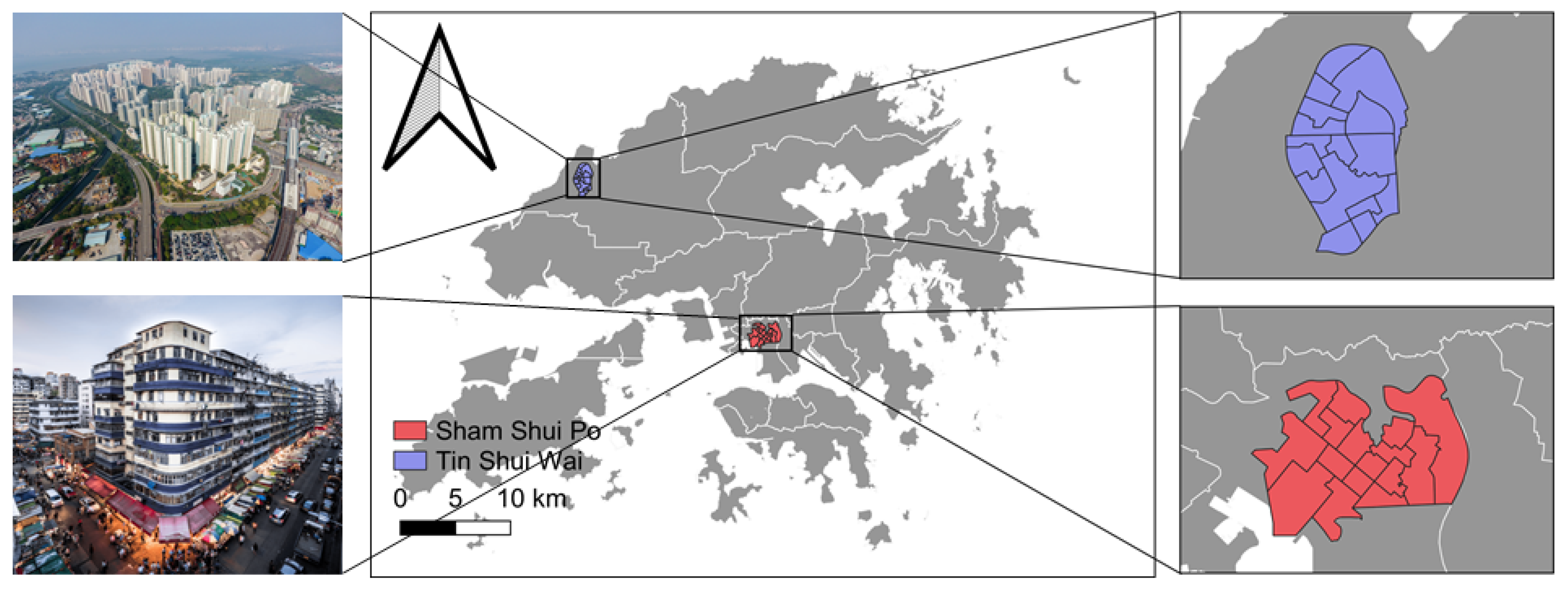

Ijerph Free Full Text Examining The Influence Of Housing Conditions And Daily Greenspace Exposure On People Rsquo S Perceived Covid 19 Risk And Distress

Ex107jeffersonatperim6e2

Probate What Is It Important Things To Know When Dying In Ontario

Mental Health And Life Course Shocks In A Low Income Country Evidence From Malawi Sciencedirect

Loan Assumption Agreement